If you have not already taken out a loan, you undoubtedly will some time in your life. For example, when you buy a house, the “mortgage” you pay is simply payment on the amount that the mortgage holder has loaned you. If you have a loan to pay your school bills, at some point you will have to repay it. This program will help you figure out how much you will need to pay per month, assuming the loan is a standard one.

Three quantities define how much a borrower has to pay per month:

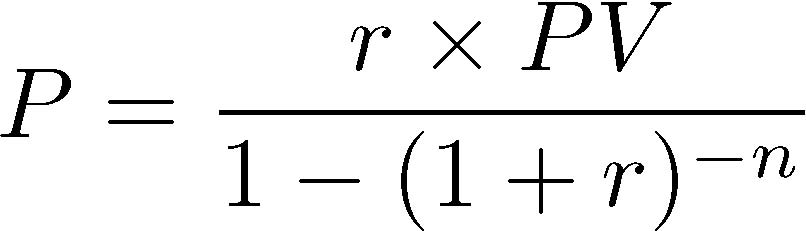

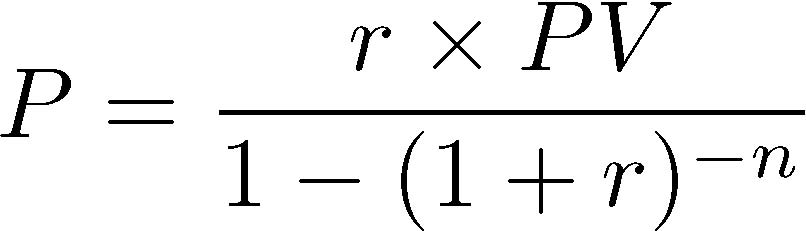

The formula for the monthly payment, which does not change throughout the repaying of the loan is:

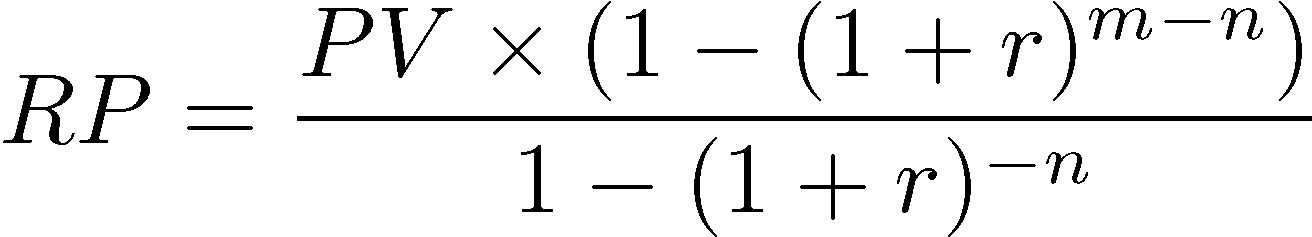

The amount of principle that is left to be repaid after m months is:

Payment schedule for a loan of $5000.00 at 6.5% interest, repaid over 1 year: month payment remaining 1 431.48 4595.60 2 431.48 4189.01 3 431.48 3780.22 4 431.48 3369.21 5 431.48 2955.98 6 431.48 2540.51 7 431.48 2122.79 8 431.48 1702.81 9 431.48 1280.55 10 431.48 856.00 11 431.48 429.16 12 431.48 0.00

Submit. Name your program “loan1.py” and submit it to the Homework #1 area for this class on SmartSite.

What is the annual interest rate (enter it without the % sign)? 6.5 How much is being borrowed (no commas)? 5000 How many years is the loan for? 1Output. The output of your program must look exactly like this:

Payment schedule for a loan of $5000.00 at 6.5% interest, repaid over 1 years: month payment remaining 1 431.48 4595.60 2 431.48 4189.01 3 431.48 3780.22 4 431.48 3369.21 5 431.48 2955.98 6 431.48 2540.51 7 431.48 2122.79 8 431.48 1702.81 9 431.48 1280.55 10 431.48 856.00 11 431.48 429.16 12 431.48 0.00Submit. Name your program “loan2.py” and submit it to the Homework #1 area for this class on SmartSite.

Hint: The print statement for the lines in the table after the second is:

print(" %3d %7.2f %9.2f" % (m, P, RP))

where m, P, and RP are as above.

| You can also obtain a PDF version of this. | Version of March 31, 2014 at 3:10PM |